Use our calculator to know how much returns you can get from your investment amount over a period of time.

Unlock high returns with our simple online Fixed Deposit process Register using your mobile number.

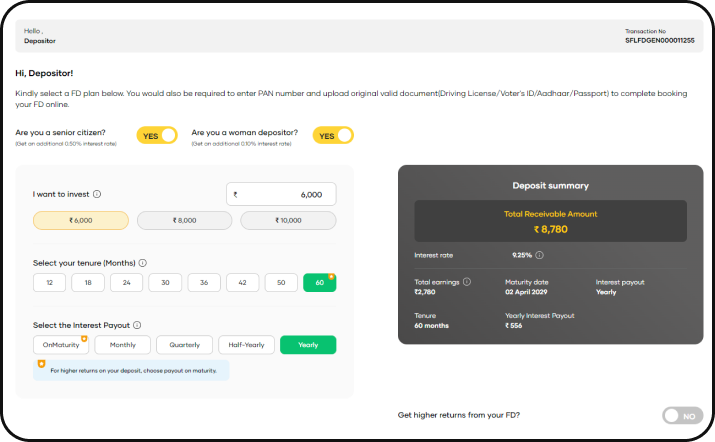

Enter the investment amount, tenure and PAN details

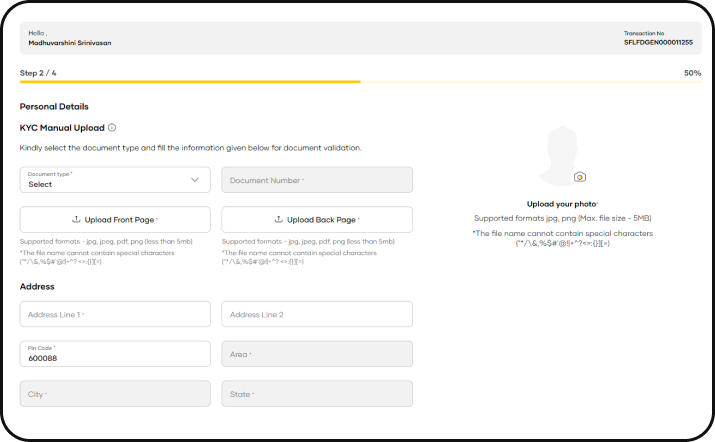

Complete your payment and proceed to enter your KYC details

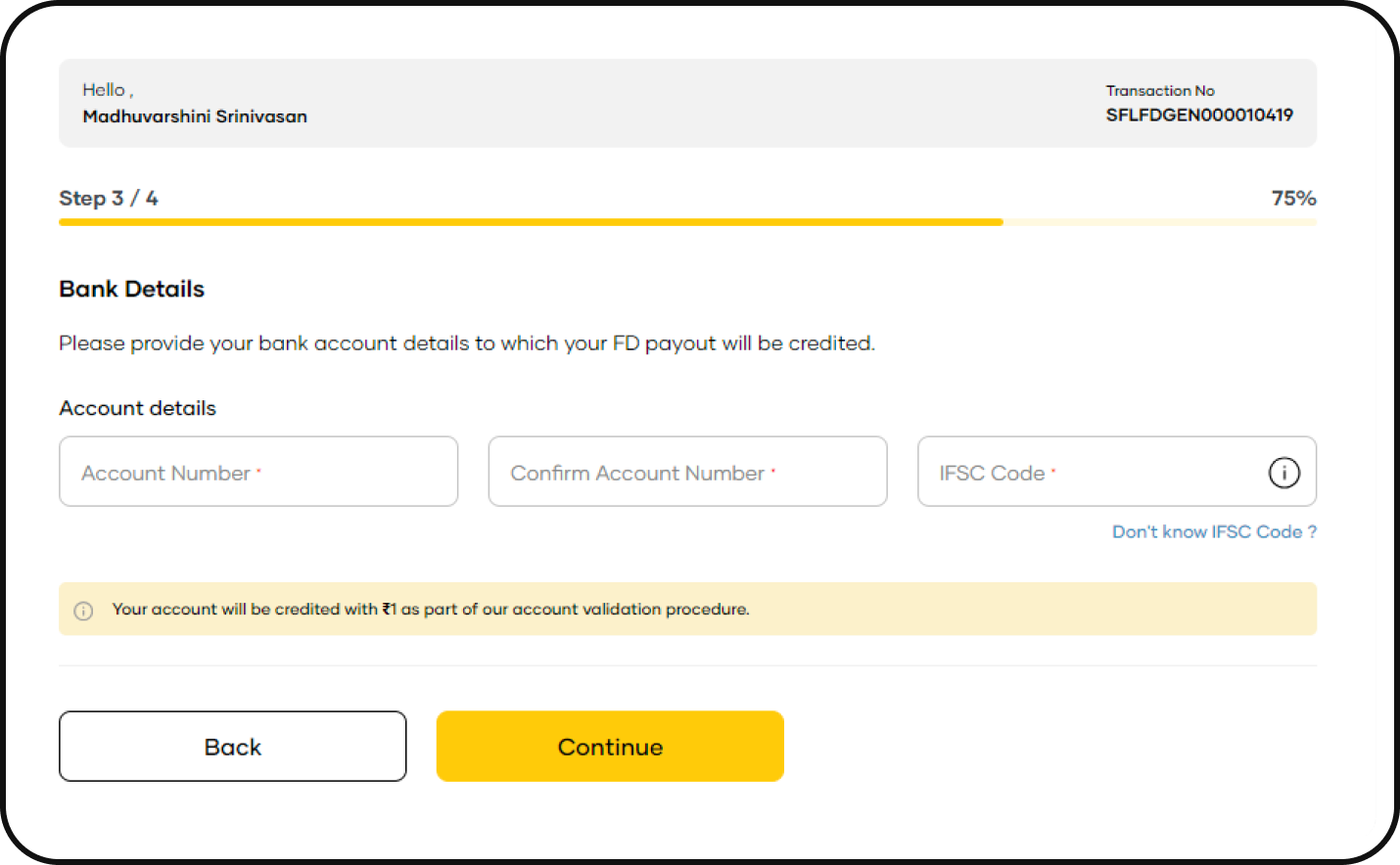

Enter the Bank details.

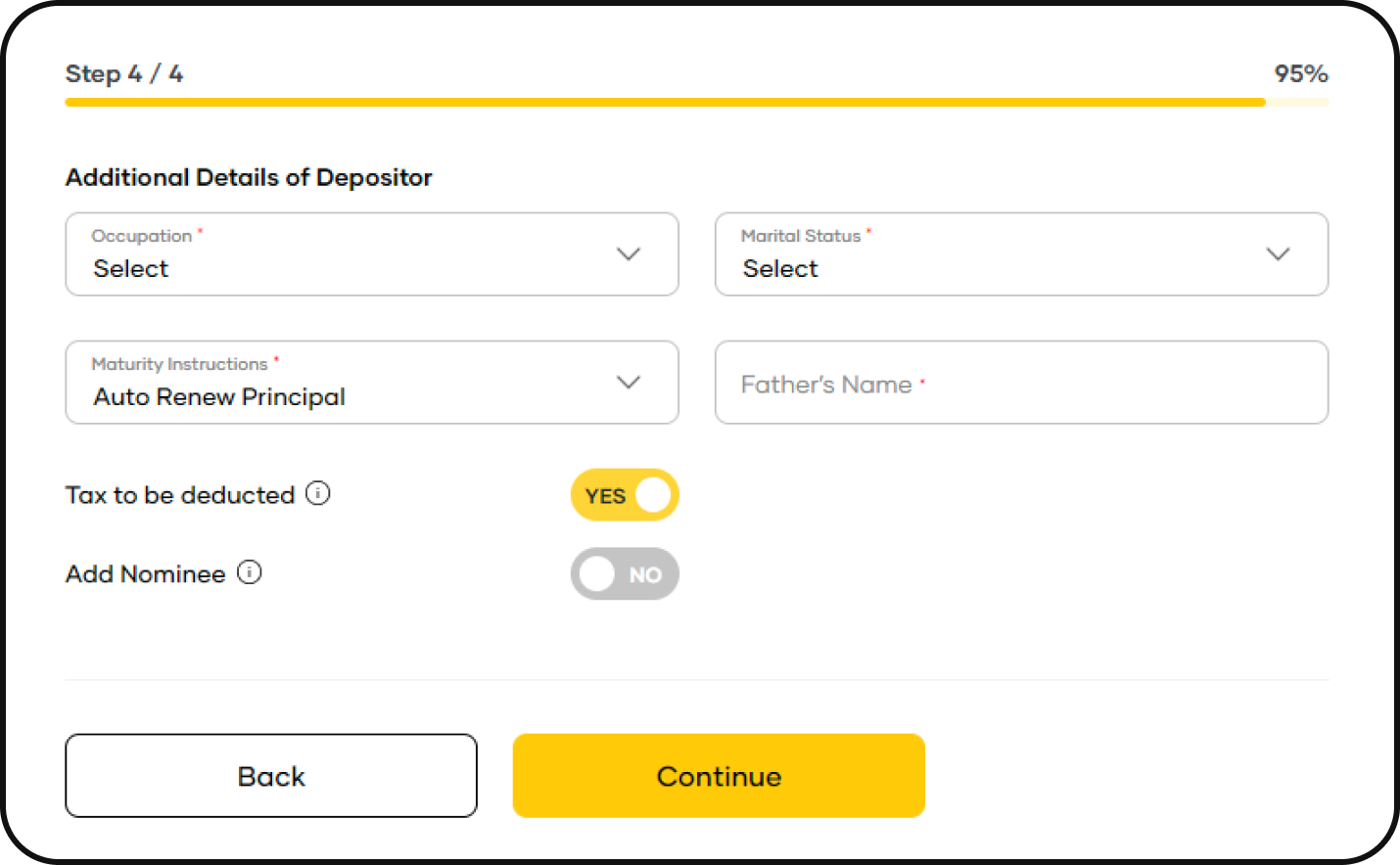

Provide the additional details and Receive fixed deposit acknowledgment.

Trusted by millions of customers, Shriram Fixed Deposit is the safest investment option with attractive interest rates.

Grow your savings with interest rates as high as 9.40%* p.a.

Senior citizens get an additional 0.50%* p.a.

Women depositors get an additional 0.10%* p.a.

Choose from the flexible investment options starting from 12 to 60 months.

Choose from flexible interest payout options, i.e., monthly, quarterly, half-yearly, yearly or at maturity.

Get steady and assured returns irrespective of market fluctuations.

Fixed Returns up to 9.40%*

Invest NowINTEREST RATES-ON FRESH DEPOSITS/RENEWALS ( w.e.f 9th April 2024)

| Period (Months) | Monthly % p.a. | Quarterly % p.a. | Half-Yearly % p.a. | Yearly % p.a. |

|---|---|---|---|---|

| 12 | 7.39 | 7.44 | 7.51 | 7.65 |

| 18 | 7.53 | 7.58 | 7.65 | 7.80 |

| 24 | 7.63 | 7.68 | 7.75 | 7.90 |

| 36 | 8.09 | 8.15 | 8.23 | 8.40 |

| 50 | 8.09 | 8.15 | 8.23 | 8.40 |

| 60 | 8.09 | 8.15 | 8.23 | 8.40 |

| Period (Months) | Rate % (p.a. at monthly rests) | Effective yield % p.a. | Maturity value for Rs. ₹ 5000/- |

|---|---|---|---|

| 12 | 7.39 | 7.65 | 5382 |

| 18 | 7.53 | 7.95 | 5595 |

| 24 | 7.63 | 8.21 | 5821 |

| 36 | 8.09 | 9.12 | 6368 |

| 50 | 8.09 | 9.58 | 6996 |

| 60 | 8.09 | 9.93 | 7482 |

Additional interest of 0.50%* p.a. will be paid for Senior citizen (Completed age 60 years on the date of deposit/renewal)

Additional interest of 0.25%* p.a. will be paid on all renewals , where the deposit is matured.

Additional interest of 0.10%* p.a. will be paid to Women Depositors.

The latest interest rates offered by top banks for terms ranging from seven days to 10 years as of November 2023 are listed in the table below

| Name | Tenure | General Public Interest Rates p.a. | Senior Citizen Interest Rates p.a. |

|---|---|---|---|

Shriram Finance limited | 1year - 5years | 9.40% | 9.90% |

Equitas Bank | 1year - 5years | 8.20% | 8.70% |

Canara Bank | 1year - 5years | 6.85% | 7.35% |

SBI Bank | 1year - 5years | 6.80% | 7.30% |

Axis Bank | 1year - 5years | 6.70% | 7.20% |

ICICI | 1year - 5years | 6.70% | 7.20% |

HDFC bank | 1year - 5years | 6.60% | 7.10% |

Our customer support team will reach out to you shortly